The first step towards your retirement planning should be to find out about your state pension.

The state pension for many will provide an increasing guaranteed lifetime income stream that will go a long way to meet essential normal expenditure.

How Much Will I Get?

The new single state pension was introduced in April 2016 and currently today provides a weekly income of £175.20 per week/£9,110.40 per year. (Not to be sniffed at)!

It also comes with a “triple lock” inflation guarantee, meaning it will increase each year by the higher of any three of the following measures:

- Average earnings

- Prices, as measured by the Consumer Prices Index (CPI)

- or 2.5%

For example, if average earnings increase by 4% then the state pension would also increase by 4%. If the Consumer Price Index was 3%, as the average earnings is the higher the 4% would still be used.

How long the triple lock guarantee will remain in place only time will tell.

How Do I Qualify For The State Pension?

- You will need 35 years National Insurance Contributions

- You need a minimum of 10 years records but they don’t have to be in a row.

- You may also get credits if you have been a carer, parent, been ill, or unemployed and even grandparents that provide care for their grandchildren under the age of 12.

Are You Missing Out? – Child Benefit High Income Benefit Charge (HIBC)

HIBC was introduced in 2015 and affects parents if you have an individual income over £50,000 and either:

- you or your partner get Child Benefit

- someone else gets Child Benefit for a child living with you and they contribute at least an equal amount towards the child’s upkeep

- It doesn’t matter if the child living with you is not your own child.

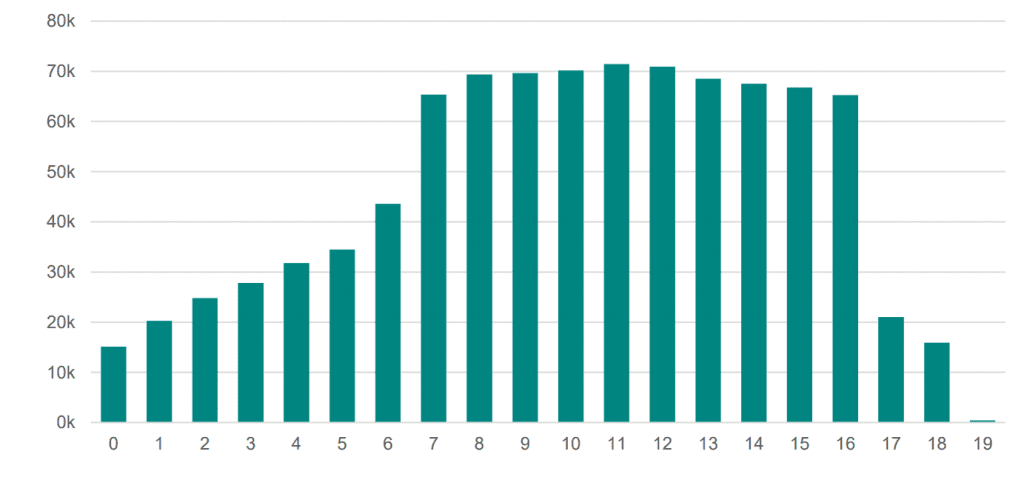

Research suggests that following the introduction of the HIBC in 2015 there has been a dramatic reduction of children age 6 or younger where families have opted out.

It also suggests that these families may have chosen not to register at all for Child Benefit after learning about the HICBC.

After trying out the online calculator for myself I can see how it would be quite easy to assume you are not entitled and don’t further bother to claim the National Insurance credits.

Putting Shortfalls Into Monetary Terms

Putting this into monetary terms – 5 years loss of NI credits amounts to a around £25 a week in state pension.

Assuming you live for 25 years beyond receiving your state pension and it increases at 2.5% per annum this would amount to an estimated total loss of around £44,405!

As many face unemployment or reductions in earnings check out to see if you are able to now receive child benefit or that you have applied to ensure you are not missing out.

Are Grandparents Missing Out?

Half of Britain’s 7 million working-age grandparents have a grandchild under the age of 16 and you may be entitled to the “Specified Adult Childcare Class 3 Credits.”

To apply you must be a family member over 16 but under State Pension age and caring for a child under 12 (usually while the parent or main carer is working).

This includes care that you’re providing from a distance because of coronavirus (COVID-19) – for example, by telephone or video call while you’re self-isolating

Getting A State Pension Forecast

The forecast will tell you:

- What age you will receive your state pension

- How much you will receive

- You National Insurance Contributions and any shortfalls needed to get the 35 years.

Is It taxable?

Yes, the state pension is taxable. It will be added on to any of your other taxable earnings and taxed as income.

What Happens To My State Pension If I Die?

If you are in receipt of the new state pension is a single pension and does not pass to anyone when you die.

Can I Increase My State Pension?

If you have any shortfall you can look to boost your pension by:

- By making additional voluntary payments.

- You may be able to claim a pension based on the National Insurance contributions of your current or former spouse or civil partner.

- Postpone claiming your State Pension and get a higher pension at a later date.

How To Get A State Pension Forecast

You can request your forecast in the following ways:

Planning for your retirement can seem a daunting task. Whilst it can all seem overwhelming once you get on track it becomes simpler to understand and one thing less to worry about.

To arrange a free initial consultation to discuss your retirement planning call me on 0113 243 2266 or email tracy.simpson@2plan.com or book a consultation

Look forward to hearing from you.

Tracy X

The above information is provided for informational purposes and constitutes the writer’s own opinions and should not be regarded, or intended to provide specific advice or recommendations for any individual, any specific financial services product, legal or tax advice.

Any information is at time of writing and may be subject to change.

The Financial Conduct Authority (FCA) does not regulate legal advice or tax advice. If you need advice in these areas then seek the professional services of a suitably qualified person.